Bookkeeping

If we own 100 shares, we will receive 10 more shares, making our total 110 shares. In a typical 2-for-1 stock split, every shareholder will receive one additional share for each share they hold. The price per share will be halved, but the total value of the shares held remains unchanged. For example, if we own 100 Certified Bookkeeper shares priced at $50 each before the split, after the split, we will have 200 shares priced at $25 each. When we look into the mechanics of issuing stock splits and stock dividends, it’s essential to understand the specific processes involved and their impacts on shareholders.

What Is a Cash Dividend?

Discover dividend stocks matching your investment objectives with our advanced screening tools. Any information posted by employees of IBKR or an affiliated company is based upon information that is believed to be reliable. However, neither IBKR nor stock split vs stock dividend its affiliates warrant its completeness, accuracy or adequacy. IBKR does not make any representations or warranties concerning the past or future performance of any financial instrument.

Stock Split vs. Reverse Stock Split

This is typically done to make shares more affordable to investors. With more affordable share prices, a broader range of investors might buy into the company. This increased activity can sometimes drive the stock price up over time. In many jurisdictions, stock dividends are not subject to immediate taxation. Instead, the tax liability is deferred until the investor sells the shares.

- Our platform features differences and comparisons, which are well-researched, unbiased, and free to access.

- In this, what exactly happens is that the company does not issue any shares, rather the outstanding shares are split or divided into a definite ratio.

- Discover dividend stocks matching your investment objectives with our advanced screening tools.

- On the other hand, if the company declares a stock dividend of 0.2, the shareholder’s payment comes in the form of stock shares.

- In reality, it distributes the company’s general reserves into the share capital of the company.

- It should be noted that this dilution is the immediate effect of a stock dividend.

Objectives of Distributing Stock Dividends

- Many stock exchanges have minimum limits on the value of the stocks that trade on the exchange.

- Just like in stock dividends, dividends are transferred from retained earnings to the capital accounts and the shareholders will maintain the amount of their total market value.

- Different goals are achieved and different impacts are observed since the issuing of extra shares to current stakeholders is experienced with both stock dividends and stock splits.

- For example, if a stock split happens, the prior year’s earnings per share figure should be altered to account for the larger number of shares.

- Companies often issue stock dividends to conserve cash while still providing value to shareholders.

- Instead of declaring cash dividends, corporations prefer issuing stock dividends as payment for plenty of reasons which will be discussed later on.

This may or may not appease shareholders who have been used to receiving cash dividends on a regular basis. Both stock dividends and stock splits can be seen as positive signals by the market. They indicate that the company is financially healthy and confident in its future prospects. However, stock dividends may be viewed as a stronger signal of financial strength, as they involve the distribution of additional shares using the company’s retained earnings. Stock splits, on the other hand, may be seen as a signal of the company’s desire to attract more investors and improve market liquidity.

However, the declaration of stock dividends may also a sign that a company does not have enough cash. For example, in a 2-for-1 stock split, each existing share is split into two shares, and the price per share is halved. If an investor owns 100 shares priced at $100 per share before the split, they will own 200 shares priced at $50 per share after the split. A cash dividend typically won’t be issued to new shares that were created if the split date occurs after the dividend’s date of record.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. The actual practice seems to be mixed between these two approaches.

- As an alternative to debiting Retained Earnings (if allowed by state law), some firms choose to debit Additional Paid-In Capital or Capital in Excess of par.

- With a stock split, the number of shares increases, and the price of each share decreases.

- For shareholders, stock dividends provide an opportunity to own more shares without additional investment.

- A stock split typically indicates that a company is succeeding and that its stock price has increased.

- Ask a question about your financial situation providing as much detail as possible.

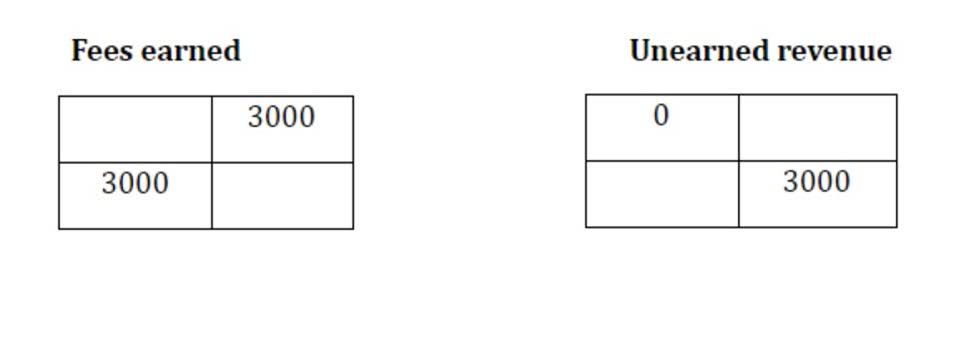

A stock’s price may rise as its value increases to the point where certain investors are unable to purchase it. Through the division of stock into many shares, stock splits lower the price of a stock. But a stock dividend is balance sheet a payment made to shareholders in the form of additional equity shares as opposed to cash. In this scenario, every stockholder receives additional shares from the firm’s free reserves, but the total market value of the company stays the same. The company’s lack of cash flow is the primary cause of the stock dividend. Although shareholders will perceive very little difference between a stock dividend and stock split, the accounting for stock dividends is unique.

Scott received his Master of Business Administration from Loyola University with a concentration in finance and owned and operated a successful business for 10 years. Build conviction from in-depth coverage of the best dividend stocks. You must be a shareholder on or before the next ex-dividend date to receive the upcoming dividend. In November 2024 Palo Alto Networks (PANW) announced a 2-for-1 stock split. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.