This suggests that the firm should try to find quality material at a lower cost and lower its direct expenses if possible. You would do this for each of the other line items to determine the common size income statement figures. It’s worth noting that calculating a company’s margins and the common size calculation are the same. To find the net profit margin, you simply divide net income by sales revenue.

What is the common size balance sheet formula?

Common size financial statements can have a range of limitations. However, it’s important to recognize that some of these limitations come due to various interpretations of the data being observed. However, a more popular version breaks down cash flow in a different way and expresses line items in terms of cash flows from operations. It will also include total financing cash flows and total investing cash flows for both of those activities. Conducting a common size analysis is relatively straightforward to do. All you need to have is the percentage of the base amount, the total amount of an individual item, and the amount of the base item.

How to Build Common-Size Financial Statements

Although the income statement is typically generated by a member of the accounting department at large organizations, knowing how to compile one is beneficial to a range of professionals. Correctly recording prepaid expenses and depreciation is crucial. This can be facilitated by advanced accounting software, which automates and minimizes errors in entries. Assume Sporty Shoes has just completed its first year of trading. This means that the above income statement is the only one it has.

Key Takeaways

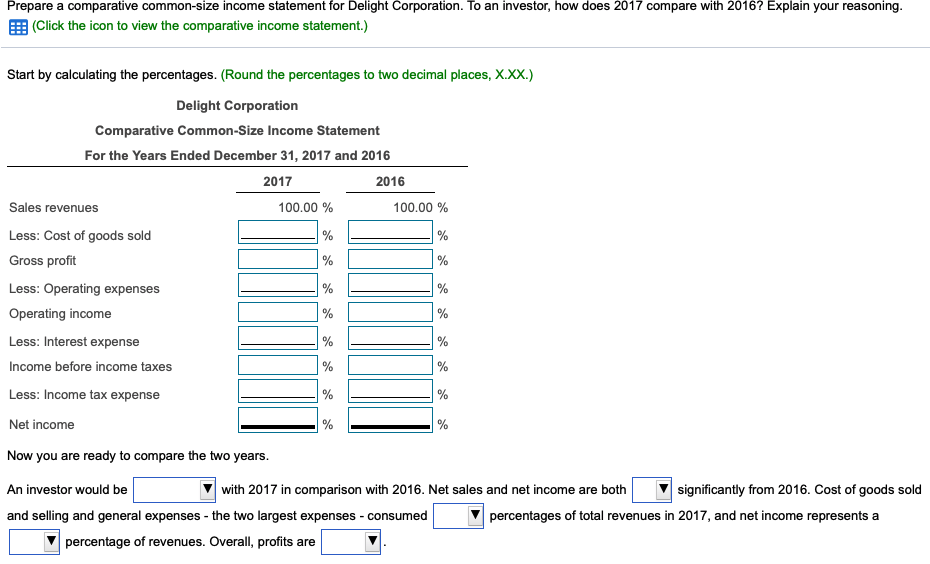

Financial ratios and common-size income statements can assist in measuring profitability aside from offering quick insights into changes in a company’s financial performance. Conducting a common size balance sheet analysis can let you quickly see how your assets and liabilities stack up. Ideally, you want a low liability-to-asset ratio, as this indicates you will be able to easily pay your business’s obligations. This low ratio is favorable especially if you’re applying for a business loan, since lenders want to be assured that you’re financially solvent enough to take on and repay additional debt. For each line item on this sample income statement, we’ve shown the percentage that it makes up of total revenue.

- Now that you have covered the basic financial statements and a little bit about how they are used, where do we find them?

- Common Size Income Statement presents every line item available in the company’s income statement in the form of the relative percentage of sales.

- We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan.

- Next, $560.4 million in selling and operating expenses and $293.7 million in general administrative expenses were subtracted.

Precise financial records require proper categorization of expenses and revenues. Errors often arise from misclassifications and omissions of one-time gains. Utilize accounting software and a detailed checklist to ensure accurate entries and comprehensive income tracking. As you start preparing income statements, here are three factors to consider to make the process easier and ensure accuracy.

For example, if a person states that they led a $100 million company, you usually assume that number refers to the revenue of the company. Peer groups within an industry are often grouped by their revenue amounts. The power of revenue as a base number carries from the income statement to the statement of cash flows. The net and gross profit margins are two ratios that may be found through common sizing of the income statement. The current assets formula determines that the “total current assets,” which are the total of all assets that can be converted to cash within one year, makes up 37% of the company’s total assets.

Let us try to undestand the concept of common size income statement interpretation with the help of some suitable examples. However, a simple tool like Microsoft Excel can be quite handy in making the process easier and faster. The same formula can be copied and replicated in each income statement line, examples of itemized deductions making the calculations much faster. In Figure 5.21, you can see the formulas used to create Clear Lake Sporting Goods’ common-size income statement in Excel. Notice that the $ can be inserted to anchor a cell reference, making it easier to copy and paste the same formula onto many lines or columns.

A quarterly or annual report, on the other hand, provides analysis from a higher level, which can help identify trends over the long term. Your reporting period is the specific timeframe the income statement covers. Incorporating absolute figures and industry benchmarks alongside common size percentages can help mitigate these limitations. Companies in other industries may show their product mix analyses using a base number of total revenue or equity. Share repurchase activity as a percentage of total sales in each of the three years was minimal or non-existent.

Trendy Trainers has also prepared a common-size income statement for the same year. This would come at the expense of good profit margins but would increase revenues. Horizontal analysis relates to specific line items and then compares them to a similar item that was included in the previous financial period. Vertical analysis relates to analyzing specific line items against the base item, and this is from the same financial period. It’s actually a part of a decomposition of how most companies do product mix analysis.

This common-size income statement shows an R&D expense that averages close to 1.5% of revenues. All three of the primary financial statements can be put into a common-size format. Financial statements in dollar amounts can easily be converted to common-size statements using a spreadsheet. Common-size Statements are accounting statements expressed in percentage of some base rather than rupees.