Under current accounting conceptual frameworks, this meets the definition of an asset – it’s that simple. The total liability balance (short-term and long-term liability balances) is often used by stakeholders to evaluate whether to invest or lend to an organization. Potential investors or lenders use those balances in prepaid rent assets or liabilities financial ratios that often greatly contribute to decision-making. Organization’s lease activity is more transparent, which was ultimately the goal of the FASB’s issuance of a new lease accounting standard. They have the ability to generate cash inflows or decrease cash outflows in order to produce economic benefit.

Accrual Basis Accounting

Consistent with the matching principle of accounting, when the rent period does occur, the tenant will relieve the asset and record the expense. A typical scenario with prepaid rent is mailing the rent check early so the landlord receives it by the due date. You can think of prepaid expenses as the costs that have been paid but are yet to be utilized. Under both ASC 840 and ASC 842, the formula to calculate straight-line rent expense is total net lease payments divided by the total number of periods in the lease. As time passes and the rental period covered by the prepayment begins, the prepaid rent is recognized as an expense on the income statement.

What is Accounts Receivable Collection Period? (Definition, Formula, and Example)

Visual Lease Blogs – read about the best lease administration software, lease management solutions, commercial lease accounting software & IFRS 16 introduction. Let us now turn to the landlord and see why they have a liability (of course, it makes “natural sense” if the tenant has an asset … but let’s check it out anyway). The IFRS Conceptual Framework referenced above defines a liability as “… a present obligation of the entity to transfer an economic resource as a result of past events” (para 4.26). We like to go to the International Financial Reporting Standards (IFRS) Conceptual Framework for our reference point in definitions. It defines an asset as “… a present economic resource controlled by the entity [or person] as a result of past events” (para 4.3). The framework goes onto defining an economic resource as “… a right that has the potential to produce economic benefits” (para. 4.4).

The Journal Entry for Prepaid Rent

The Landlord agrees to provide a $200,000 tenant improvement allowance to be paid upfront at the commencement of the lease. Then, this security deposit upon the satisfaction of certain conditions can be refundable at the end of the lease. Alternatively, this security can also be treated as a nonrefundable advance payment that covers the months at the tail end of the agreement.

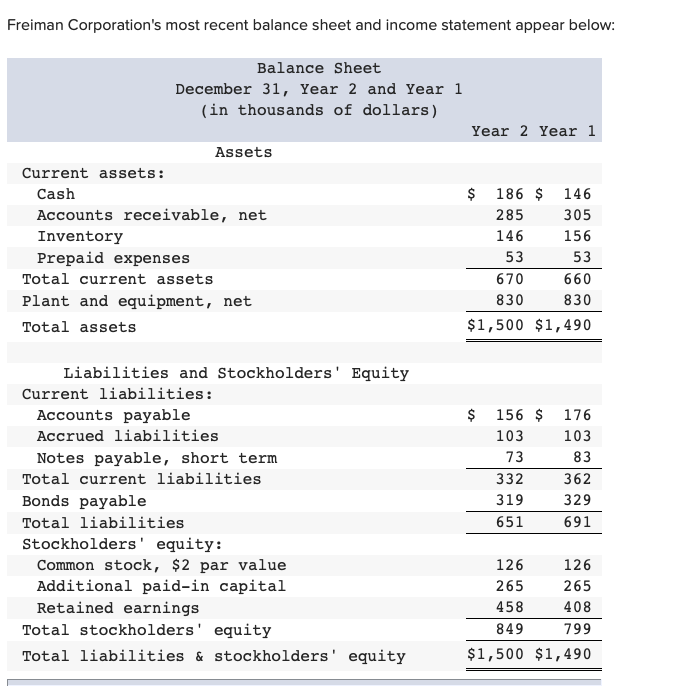

To further illustrate the analysis of transactions and their effects on the basic accounting equation, we will analyze the activities of Metro Courier, Inc., a fictitious corporation. Accrued revenue—an asset on the balance sheet—is revenue that has been earned but for which no cash has been received.We want to increase the asset Cash and increase the equity Common Stock. Accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out.

- In the period when prepaid rent is paid but not due, there will be no record in the income statement.

- It represents an asset on the company’s balance sheet, as the prepayment can be utilized to offset rent expenses in the future when it is incurred.

- Generally, variable, or contingent rent, is expensed as incurred according to both legacy accounting and the new accounting standard.

Prepaid rent as a current asset

The entry for the ROU asset is a debit to Lease Expense for $33,469 and a credit to Right-of-use (ROU) Asset for the same amount to record the amortization. They pay the lessor three months in advance on the first day of every quarter. On the 1 of January they pay an advance of $6,000 to cover the first three months of the year. It is still only reported on the income statement and calculated on a straight-line basis.

The combined lease expense is now reported in the operating section of the income statement under ASC 842 in place of rent expense. Conclusively, prepaid rent is said to be a permanent account since it is reported as a current asset on the balance sheet. Permanent accounts are accounts on the balance sheet, which include transactions related to assets, liabilities, and equity.

For a full explanation with journal entries, read our blog, Accrued Rent Accounting under ASC 842 Explained. For instance, a one-year lease may require an initial payment covering the first and last months. This prepaid rent ensures the landlord has funds in case of default and provides the tenant with proactive protection against future rent increases.

A company makes a cash payment, but the rent expense has not yet been incurred so the company has prepaid rent to record. Prepaid rent is an asset – the prepaid amount can be used by the entity in the future to reduce rent expense when incurred in the future. The periodic lease expense for an operating lease under ASC 842 is the product of the total cash payments due for a lease contract divided by the total number of periods in the lease term. If all details of a contract are the same, organizations record the same amount for lease expense under ASC 842 as they would for rent expense under ASC 840.